One remarkable statistic is that the cost of building the three ‘Olympic’ class ships was more, in cash terms, than the value of the entire White Star Line fleet as at September 1908. That month, the company’s twenty-three ships were worth £4,850,000. Olympic and her sisters comfortably exceeded that.

On 1 August 1907, an agreed schedule of ‘instalments due’ was confirmed for Olympic and Titanic. Harland & Wolff would require payments from the White Star Line at five stages of construction: when the keel was laid; when the ship was framed to the height of the double bottom; when the ship’s hull plating was complete; when the ship was launched; and when the ship was delivered. The arrangements were the same as for the majority of ships Harland & Wolff completed for different shipping lines in the 1890s and 1900s. Similarly, they followed the standard White Star and IMM practice whereby the shipbuilder would take the cost of the ship and then add on a percentage commission on top: ‘cost plus’. The same practice was followed later for Britannic.

While it was quite natural that the shipbuilder needed to be reimbursed for the costs they were incurring throughout the construction process, the schedule of payments meant that the White Star Line would need to start making payments for their new ships long before they were completed or earning revenue.

Construction of Olympic and Titanic started three months apart with the laying of their keels in December 1908 and March 1909, respectively, so that multiple payments needed to be made throughout 1909 and 1910. Nine of the ten instalments were paid by the time Titanic was launched in May 1911.

How did White Star raise the finance to pay for these ships?

The popular answer is that they were financed with American money, either through JP Morgan or IMM. However, the truth is the opposite.

White Star was not supported by IMM’s resources.

IMM was supported by White Star’s resources.

There are essentially three ways for a company to raise money. It can:

- raise equity capital (issue shares and then receive money from the new shareholders);

- raise debt capital (issue bonds and then receive money from the new bondholders);

- obtain funds from current or retained profits.

The benefit of raising equity capital for a company is that it does not have to pay it back to the investor. An investor will typically receive a share of the company’s profits in the form of dividends, which vary according to how profitable the company is and what portion of their profits they chose to distribute to their investors.

Raising debt capital obligated them to pay it back when the bonds were redeemed. The bonds also carried a fixed rate of interest which meant that these debt interest payments needed to be paid to the bondholders regardless.

The White Star Line (legally known as the Oceanic Steam Navigation Company) had started off by raising equity capital. By March 1880, the company had issued 750 shares of £1,000 each which were fully subscribed, meaning that each shareholder had paid the full £1,000 for each of their shares. (The shares were privately held rather than publicly listed, so their price was not thereafter quoted on a public stock market.)

Almost all the company’s shares were acquired when IMM was formed, with a couple of exceptions. The combine controlled the White Star Line as the majority shareholder. In order to raise equity capital, IMM would have needed to come forward with the funds and subscribe for more shares.

It seems unlikely that this was a viable option. When White Star passed into American ownership, each shareholder received £14,265 per share. The amount was made up of a mix of £4,143 in cash, £6,713 in preference shares in IMM, £3,356 in ordinary shares in IMM and a £52 deduction (in round numbers). The valuation this represented amounted to 13.7 times White Star’s net earnings for 1900 (an extraordinarily profitable year) and 23.6 times its net earnings for 1901 (whose results were more typical). In other words, IMM had, arguably, overpaid for control of White Star and its assets, relative to its earning power.

In the annual report for 1903, IMM argued that: ‘with harmonious cooperation among the several lines and the elimination of unnecessary duplication of expenditures, it seems reasonable to expect that the ratio of operating expenses to earnings should be substantially diminished and that out of such large gross earnings the net return for future years should be increased over the result of this year’.

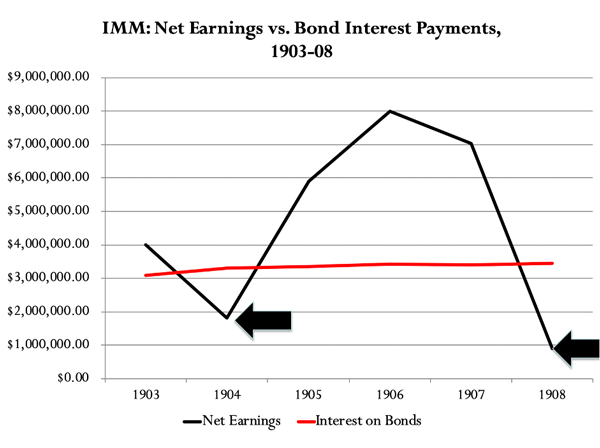

Using the ‘average rate earned per ton during the five years’ from 1897 to 1902 and ‘applying that rate to the tonnage actually in service during 1903’, the combine would have reported net earnings of ‘about $9,500,000’ even ‘without taking into account any savings in expense brought about by the harmonious cooperation of the several lines under the coordinated management which is now assured’. For a variety of reasons beyond the scope of this article, IMM did not meet expectations: net earnings only reached over $8,000,000 in 1906 and did not exceed $9,500,000 until 1913. As a consequence, IMM was unable to pay a dividend to its common shareholders and did not pay a dividend on its preference shares until 1917. From 1903 to 1914 an average of 58 per cent of IMM’s net earnings was swallowed up simply paying the interest payments to its own bondholders. Subscribing for more, newly-issued shares in White Star, would mean committing even more capital.

Nor was borrowing the money by issuing bonds a viable option. The majority of IMM’s net earnings were swallowed up by debt interest payments in any case, but in 1904 and 1908 IMM actually reported losses after debt interest payments and income tax were deducted from its net operating profits. Naturally, holders of IMM’s bonds were worried, because they had effectively lent money to an entity whose income was less than its obligations. Someone holding IMM bonds could sell them on the open market if they wanted to, but the market price reflected the credit risk. On 12 May 1908, for example, IMM’s 4½ per cent bonds were selling for over 72 cents on the dollar, and the price quoted on 7 July 1908 was slightly worse still. In effect, bonds which had an interest rate or yield of 4½ per cent on their redemption price were yielding 6.4 per cent to compensate for IMM’s inferior creditworthiness.1

(Extracted from ‘An “Olympic” Challenge: “We Have Reached the Limit…”’ by Mark Chirnside. Presented at the Public Records Office of Northern Ireland (PRONI), Belfast, September 2019, in conjunction with the Belfast Titanic Society.)

If IMM issued any more bonds, they would have to pay a higher yield to investors to compensate them by reflecting the market price, meaning higher borrowing costs. Issuing more bonds would also increase the company’s debt interest payments even further, exacerbating concerns about the combine’s creditworthiness.

J. Bruce Ismay, as IMM’s president, Harold Sanderson, Lord Pirrie and the remaining eleven directors of IMM concluded that an alternative approach would be for White Star to borrow the money: ‘This was considered by your directors a much more satisfactory method of financing than an attempt to sell the International Mercantile Marine Company’s Four and One-Half Per cent Bonds at their present low market price’ [my emphasis].

Unlike IMM as a whole, White Star reported a profit in 1908 – albeit substantially down on its good performance in 1907, reflecting a tough year for the shipping lines. Its balance sheet was much stronger, too. As a consequence, White Star was perceived as a safer home for an investor’s capital, even though it was controlled and operated as part of the combine. White Star’s profits went towards making up the losses incurred by other parts of IMM.

White Star’s bankers helped the company borrow £1,250,000 by issuing bonds to largely United Kingdom-based investors, paying 4½ per cent interest on the redemption price. Investors were willing to pay £97 10 shillings for each £100 bond, or 97½ per cent of the redemption price, which was substantially higher than what IMM’s bonds were trading at. Their confidence was underpinned by White Star’s assets: the fleet was valued at £4,850,000, which was security for the loan and represented almost four times the money being borrowed. The company’s average annual earnings for the ten years from 1898 to 1907 were very healthy and the total amount borrowed represented barely 1.5 times the profit reported for 1907.

The difference in borrowing costs was considerable. Assuming IMM had borrowed the money by issuing bonds to investors at 70 per cent of the issue price, to reflect the distressed prices of bonds traded on the open market, the interest rate would have been 6.4 per cent. White Star, on the other hand, effectively borrowed the money at the rate of 4.6 per cent, meaning a saving of £22,500 in interest payments in the first year and a significant saving over the long term.

Glyn, Mills, Currie & Co., of 67, Lombard Street, London, and Bank of Liverpool Ltd., acted as White Star’s bankers.

Glyn, Mills, Currie & Co. went through various changes and reorganisations until it was acquired by the Royal Bank of Scotland in 1939. In 1970, it merged with other subsidiaries to form Williams & Glyn’s Bank. Fifteen years later, it merged fully with Royal Bank of Scotland so that the name William & Glyn’s Bank disappeared. The Royal Bank of Scotland was one of the largest casualties of the ‘Credit Crunch’ and, in 2009, ran up the largest annual losses in UK corporate history.

Bank of Liverpool Ltd. acquired Martins Bank in 1918 and was known as Martins Bank from 1928. In 1969, it merged with Barclays and the name vanished as it was absorbed into the larger group.

The money borrowed was not reserved solely for Olympic and Titanic, but for the purpose of White Star’s general shipbuilding programme. Investors were advised:

the company has at present building in the yard of Messrs. Harland & Wolff, Limited, of Belfast, two steamships for a Canadian service, and has recently placed with the same firm an order for two steamships of large size and of the highest class for its Southampton and New York Royal Mail Service. The cost of these four vessels is estimated at £3,600,000.

The estimated cost for both the large ships at the time was about £3,000,000, with the two smaller liners for the Canadian service representing the remainder.

White Star’s borrowing of £1,250,000 went only part of the way to financing their new ships. The remainder came from the company’s profits, which recovered from a poor year in 1908 and exceeded £1,000,000 for the first time by 1910.

Under the terms that the money was borrowed, the funds raised could ‘only be used in payment for new property and the total amount of debentures [bonds] issued cannot exceed three-fourths of the actual value (not exceeding cost) of the new property’. The consequence was that ‘at least twenty-five per cent of the value of the new property acquired (being the excess in value over the amount of debentures issued)’ would be additional security underlying IMM’s own bonds ‘without increasing the outstanding amount of such bonds’. On the amount actually borrowed, the additional security ended up being much higher.

After reporting a net profit of £848,486 in 1907, White Star’s profit fell to under £300,000 in 1908, before recovering gradually to reach a new high of £1,073,752 in 1911. Despite a poor year in 1908, White Star was able to pay a dividend of £75,000 and then increase its annual dividend payment so that it reached £450,000 in 1911.

Taking the years 1908 to 1912 inclusive, it appears White Star paid at least £1,125,000 in dividends to its shareholders – money which went into IMM’s coffers.

IMM depended, to a large extent, on this money in order to meet its debt interest obligations. However, it is interesting to note that the amount White Star paid in shareholder dividends to IMM was not far short of the total amount of money they had to borrow to finance their shipbuilding programme. If it were not for paying substantial dividends to IMM, White Star could have financed the new ships from its own profits with very little, if any, borrowing at all.

In short, Olympic and her sisters were not financed by JP Morgan or IMM’s resources, nor did IMM support White Star financially in this sense. Instead, it was White Star whose financial resources helped underpin the IMM combine:

- White Star financed the ‘Olympic’ class ships and others by borrowing the money from largely United Kingdom-based investors, mortgaging its own fleet;

- White Star borrowed the money, rather than IMM, to take advantage of its stronger financial position and lower borrowing costs;

- The new ships provided additional security underlying IMM’s own debt, without increasing the money IMM itself borrowed;

- Dividends paid by White Star from 1908 to 1912 helped IMM meet its debt interest payments.

What about Britannic?

Britannic was laid down in November 1911 and launched in February 1914. The initial tranche of bonds issued at the end of 1908 amounted to only half the authorisation that White Star could borrow £2,500,000. (They were all due to be redeemed by June 1922.) White Star had ample scope to borrow more money and they opted to do so six years later.

In July 1914, they decided to issue a second series of bonds ‘to meet the enlarged requirements of the company’s shipbuilding programme’. It seems likely that part of the proceeds from these bonds would have been put towards the final payment for Britannic. The same month, a new steamer to be called Germanic was also laid down for the Liverpool to New York service for completion in 1916. They increased the authorised total issuance to £3,375,000 from £2,500,000, of which the second series represented £1,500,000. In total, the company borrowed £2,750,000.

The second series of bonds were sold at 95 per cent of the £100 issue price, representing a slightly higher cost of borrowing compared to the bonds issued in 1908. The bonds all carried an interest rate of 4½ per cent on their redemption price, which represented a yield of 4¾ per cent on the 1914 bonds compared to 4.6 per cent on the 1908 bonds.

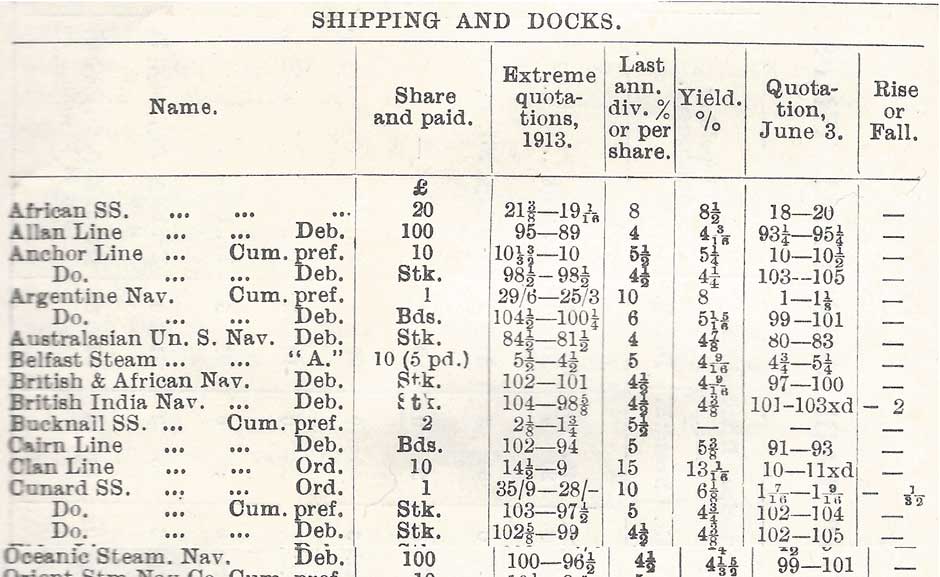

The securities were listed in alphabetical order by the name of the company, so that a large number have been omitted between ‘Cunard’ and the ‘Oceanic Steam Navigation [Co.]’ (White Star Line) for ease of comparison. Cunard was a publicly listed company with ordinary shares (Ord.), preference shares (Cum Pref.) and debenture stock or bonds (Deb.) traded publicly, whereas the only publicly traded White Star securities were the debenture bonds it had issued in 1908.

Comparing Cunard’s debenture bonds with White Star’s in 1913, Cunard’s had traded in a range of £99 to £102 5/8 whereas White Star’s ranged between £96½ and £100. One difference was that Cunard’s bonds were going to be redeemed at 102 per cent, meaning an investor would receive £102 for each £100 bond they held, whereas White Star’s were simply going to be redeemed at £100. On the basis of the highest 3 June 1914 quotations, both companies’ bonds were being valued even higher than their redemption price.

On 1 October 1914, IMM defaulted on the interest payment due on its 4½ per cent bonds; and, on 1 February 1915, they defaulted on the interest due on its 5 per cent bonds. Investor fears about the combine’s creditworthiness were confirmed. The combine went into voluntary receivership, but the war progressed and ‘there came about a most extraordinary change in the conditions of the company’, enabling a successful financial restructuring. Annual net earnings in the pre-war record year of 1913 had more than trebled by 1916 and transformed IMM’s fortunes.

(Shipbuilding & Shipping Record, 1914/Author’s collection)

An investor who purchased the first series of bonds in 1908 would have had a satisfactory return. (They paid £97½ for each £100 bond, so they received their capital back with just over 2½ per cent on top; meanwhile they received interest twice a year at 4.6 per cent.2) They had all been redeemed by June 1922. However, the second series of bonds issued in 1914 were not due to be redeemed in full until June 1943. The consequence was that a liability of £474,700 remained outstanding in 1930, when White Star began to make losses with the onset of the Great Depression.

These losses were reflected in the market prices for the company’s debt. They fell steadily. On 10 May 1929, these bonds were quoted at £95-£98. On 28 November 1930, some were traded at £92½. By 24 June 1931, the quoted prices had fallen to £70-80 and on 13 May 1932 the quotations were from £68-78. By 1 September 1933, White Star was rapidly coming to the end of its fourth calendar year of losses and confidence in the company was collapsing. Bond prices fell accordingly. They were quoted at £42-52, recovering slightly by 31 October 1933.

They remained among the company’s liabilities at the time of the Cunard White Star merger. Just as IMM’s ultimate default on its bonds was predicted in the distressed pre-war valuations of its securities, so too was White Star’s financial distress in the early 1930s, before it ceased to exist as an independent company. White Star’s financial strength in the early years of the twentieth century was a distant memory.

Notes

- On 16 April 1912, IMM’s 4½ per cent bonds were reportedly ‘$65 3/8; off $2 3/8’. (When the New York Stock Exchange began, the most that a security could change in value was an eighth of a dollar. Effectively, the bond price fell about 3½ percent and the yield rose to 6.9 percent.)

The same day, White Star’s bonds were being quoted at £100-102, a yield of between 4.4 per cent and 4.5 per cent. There was little, if any trading, in these securities and the quotations remained the same on 19 April 1912, falling to £99-101 in Saturday trading on 20 April 1912. The bond yields of IMM and White Star on 16 April 1912 indicate that IMM’s borrowing costs were about 55 per cent higher than its subsidiary company. - The return was ‘satisfactory’ in that the bonds returned exactly what was promised. Assuming someone purchased their bonds in 1908 and held them until 1922, they were redeemed at the redemption price and paid all the interest due: a gain of over 60 per cent. However, between 1908 and 1922, consumer price inflation in the United Kingdom rose by 145 per cent as World War I took its toll on the economy. As a consequence, they saw a nominal cash return but the real monetary value declined. This was an issue for all bonds paying a fixed rate of interest and was not a reflection on the White Star Line’s performance. See Morley, Kate Rose. ‘Historical UK Inflation’. 2019. http://inflation.iamkate.com (Accessed 2 January 2020).

Acknowledgements

I owe Mike Poirier a vote of thanks for encouraging me to write this article, covering a subject I’ve wanted to look at for a while. It’s now off my ‘to do’ list!

The financial aspects of White Star and IMM are often under or inaccurately reported, but they give us a lot of valuable insight. Knowing the financial side of things is greatly beneficial to understanding the whole picture. It is a shame for historians that White Star, unlike Cunard, was a private company during its first decades of existence and then a subsidiary of two combines (IMM and then Royal Mail), which means we do not have the benefit of full, public financial reports and statements to draw upon. IMM’s annual reports are valuable and are referenced throughout this article: I am grateful to the New York Public Library, who copied hundreds of pages of these for me more than a decade ago.

For further information, see:

Chirnside, Mark. ‘An “Olympic” Challenge: “We Have Reached the Limit…”’ by Mark Chirnside. Presented at the Public Records Office of Northern Ireland (PRONI), Belfast, September 2019, in conjunction with the Belfast Titanic Society.

Chirnside, Mark. The ‘Olympic’ Class Ships: Olympic, Titanic & Britannic (History Press; revised and expanded edition, 2011).

Chirnside, Mark. ‘Whatever Happened to Germanic/Homeric?’ Titanic Commutator 2013: Volume 38: Number 201: Pages 37-39.

This article was first published in Titanic International Society’s Voyage July 2020: Pages 135-39.

Comment and discuss